Bonds and Treasury Notes of the War of 1812#

By David Cho and Alexander Dubasov

Introduction#

In the decade leading up to the War of 1812, Jeffersonian finance dictated national economic and financial policy; President Thomas Jefferson advocated for a decentralized federal government and an agrarian society. However, in the final years before the outbreak of war, the nation’s finances and banking system were in a precarious position. Before the war, land sales and customs duties generated most of the government’s revenue and the government did not impose an income tax on its citizens. The Embargo Act of 1807 hurt customs revenues and in 1811, one year before the war began, Congress refused to recharter the First Bank of the US despite Treasury Secretary Albert Gallatin’s best efforts to renew it. The lack of a national bank would prove to be consequential in the financing of the upcoming war as the nation lost a potential source of loans. The United States would soon be faced with its bleakest outlook of credit since the Revolutionary War.

Outline#

Bonds and treasury notes issued during the war, according to Richard Bayley:

Treasury Notes:

1812 Issue

1813 Issue

March, 1814 Issue

Temporary Loan and December, 1814 Issue

1815 Issue, Seven Per Cent. Stock, Treasury Note Stock, Small Treasury Notes (1815)

Long Term Bonds:

Six Percent Loan of 1812

Exchanged Six Percent Stock

Sixteen Million Loan of 1813

Seven and One-Half Million Loan of 1813

Six Percent Loans of 1814

Ten Million Loan

Six Million Loan

Undesignated Loan

Temporary Loan of 1815

Six Per Cent. Loan of 1815

What’s Being Covered#

Each mini bond/note bio includes information on

Features for each bond/note

Historical context and reasons for issuance

How was the bond marketed?

Who bought the bonds and notes?

Sources

Each mini bond/note bio includes the following graphs

Market Price: price of bond/note on the open market over time (dataset:

BondPrice.csv)Quantity: quantity outstanding of bond/note over time (dataset:

BondQuant.csv)

Notes

6% was a common interest rate set during this time. According to Perkins, since 1801, most other government bonds that had been issued typically had an interest rate between 5 and 6 percent. At the same time, the Madison Administration refused to raise interest rates any higher.

Active oustanding, public holdings, and total outstanding were all the same. Therefore, the only quantity data were public holdings since public holdings are a sublevel of active outstanding, which itself is a sublevel of total outstanding. There could be many reasons for why there is only public holdings data, including simply the Treasury did not report matured or called oustanding.

# Import Data

"""

!pip3 install seaborn

!pip3 install pandas

!pip3 install numpy

!pip3 install matplotlib

!pip3 install mplcursors

!pip3 install ipympl

"""

import pandas as pd

import seaborn as sns

import matplotlib.pyplot as plt

import matplotlib.patheffects as pe

import numpy as np

import mplcursors

from matplotlib.dates import DateFormatter, MonthLocator, YearLocator

from matplotlib.ticker import FuncFormatter

bond_price = pd.read_csv("data/BondPrice.csv")

bond_quant = pd.read_csv("data/BondQuant.csv")

#%matplotlib widget

# Add hovering features

def show_hover_panel(df, scatplot, get_text_func=None):

cursor = mplcursors.cursor(

scatplot,

hover=2, # Transient

annotation_kwargs=dict(

bbox=dict(

boxstyle="square,pad=0.5",

facecolor="white",

edgecolor="#ddd",

linewidth=0.5,

path_effects=[pe.withSimplePatchShadow(offset=(1.5, -1.5))],

),

linespacing=1.5,

arrowprops=None,

),

highlight=True,

highlight_kwargs=dict(linewidth=2),

)

if get_text_func:

cursor.connect(

event="add",

func=lambda sel: sel.annotation.set_text(get_text_func(df, sel.index)),

)

return cursor

def on_add(df, index):

item = df.iloc[index]

if df.columns[1] == "Price":

parts = [

f"Date: {item.Timestamp.strftime('%Y-%m-%d')}",

f"Price: {item.Price:,.2f}",

]

else:

parts = [

f"Date: {item.Timestamp.strftime('%Y-%m-%d')}",

f"Quant: {item.Quant:,.2f}",

]

return "\n".join(parts)

# reformat dataframe to create separate timestamp and price columns

# drop NaN columns

def melt_clean_price(df):

# Drop columns with NaN

clean_df = df.dropna(axis=1)

df_melted = clean_df.melt(var_name='Timestamp', value_name='Price')

df_melted = df_melted.iloc[2:].reset_index(drop=True)

return df_melted

# remove ax from parameter and uncomment fig, ax

# Graph for price function

def graph(df, title, graph_type):

sns.set(style="darkgrid")

# convert timestamp dtype into datetime dtype

df['Timestamp'] = pd.to_datetime(df['Timestamp'])

# Set up Seaborn plot

fig, ax = plt.subplots(figsize=(8, 6))

scatplot = sns.scatterplot(data=df, x='Timestamp', y=graph_type, marker='o')

#scatplot.axvspan(xmin=pd.Timestamp("1819"), xmax=pd.Timestamp("1822"), fc="#E0837F")

# Format x-axis ticks to show year

date_form = DateFormatter("%Y")

#ax.xaxis.set_major_formatter(date_form)

#ax.xaxis.set_major_locator(YearLocator(2))

plt.gca().xaxis.set_major_formatter(date_form)

plt.gca().xaxis.set_major_locator(YearLocator(2))

# Get the minimum and maximum dates with data (assuming 'date' is a datetime type)

min_date = df['Timestamp'].min()

max_date = df['Timestamp'].max()

# Set the x-axis limits to exclude extra years

plt.xlim(min_date, max_date)

# Enhance plot aesthetics (optional)

plt.xlabel('Year')

plt.title(title)

plt.grid(True)

if graph_type == "Quant":

# reformat y-axis to be in millions, not tens of millions

if df["Quant"].max() > 1e6:

ax.yaxis.set_major_formatter(FuncFormatter(lambda x, _: '{:.1f}'.format(x / 1e6)))

plt.ylabel('Total Outstanding (millions)')

else: # otherwise use hundred thousands label

ax.yaxis.set_major_formatter(FuncFormatter(lambda x, _: '{:.1f}'.format(x / 1e5)))

plt.ylabel('Total Outstanding (hundred thousands)')

show_hover_panel(df, scatplot, on_add) # add cursor hover features

plt.plot(df['Timestamp'], df[graph_type])

return plt # return completed figure

# clean quant dataframe

# returns a series with chosen row

def clean_quant(quant_df):

subset_cols = quant_df.columns[2:]

# Drop rows where all columns are Nan

temp_clean_quant_df = quant_df.dropna(how="all", subset=subset_cols).dropna(axis=1)

# print(clean_six_percent_prices)

# print(temp_clean_six_percent_quant)

# Define the threshold

threshold = 0.001

# Function to check if all values in a column are close to zero

def is_close_to_zero(col, threshold):

return np.all(np.abs(col) < threshold)

cols_to_drop = [col for col in temp_clean_quant_df.iloc[:, 2:].columns if is_close_to_zero(temp_clean_quant_df[col], threshold)]

# Drop the columns

clean_quant_df = temp_clean_quant_df.drop(columns=cols_to_drop)

return clean_quant_df

# print(clean_quant_df)

def reformat_quant(clean_quant_df, row):

# reformat dataframe to include timestamp and quant columns

series_data = clean_quant_df[clean_quant_df["Series"] == row].melt(var_name='Timestamp', value_name='Quant')

series_data = series_data.iloc[2:].reset_index(drop=True)

series_data['Timestamp'] = pd.to_datetime(series_data['Timestamp']) #convert timestamp column to a datetime object

return series_data # return the selected row

# Add a historical marker

# An important event

def add_marker(axis, event_str, date, y_coord, font_size):

axis.annotate(event_str,

xy=(pd.Timestamp(date), y_coord), xycoords='data',

xytext=(30, 10), textcoords='offset points', size=font_size,

arrowprops=dict(facecolor='black', shrink=0.05))

# color background to define a period

def add_period(plot, begin, end):

# ax.text(pd.Timestamp("1820-06"), 90, 'Panic of 1819', horizontalalignment='center')

plot.axvspan(xmin=pd.Timestamp(begin), xmax=pd.Timestamp(end), fc="#E0837F")

# create an interactive scatter plot of quantity data

def generate_quant_plot(quant_df, title, axis):

axis.plot(quant_df["Timestamp"], quant_df["Quant"])

# c_quant_df = quant_df.drop_duplicates(subset=["Quant"], keep="last") # drop duplicate points to keep graph minimalist

quant_scatplot = axis.scatter(data=quant_df, x='Timestamp', y='Quant', marker='o')

axis.title.set_text(title)

# reformat y-axis to be in millions, not tens of millions

if quant_df["Quant"].max() > 1e6:

axis.yaxis.set_major_formatter(FuncFormatter(lambda x, _: '{:.1f}'.format(x / 1e6)))

axis.set_ylabel('Total Outstanding (millions)')

else: # otherwise use hundred thousands label

axis.yaxis.set_major_formatter(FuncFormatter(lambda x, _: '{:.0f}'.format(x / 1e5)))

axis.set_ylabel('Total Outstanding (hundred thousands)')

show_hover_panel(quant_df, quant_scatplot, on_add) # add mouse hovering

Treasury Notes#

Treasury notes were short term bonds that the government issued during the War of 1812 to make up for the poor selling of long-term bonds. These notes were typically redeemable after 1 year and could be used to pay duties, taxes, and purchase land. In total, there were five separate issues of notes. While early issues had large denominations (e.g. $100 and $1000), future issues included smaller denominations (e.g. $3 and $20). Overall, these notes were a success by acting as a form of paper currency.

Source: Monetary Aspects of the Treasury Notes of 1812 by Donald H. Kagin

# Market Price of Treasury Notes

treasure_notes_prices = bond_price[bond_price["L1 ID"] == 20050]

treasure_notes_melted = melt_clean_price(treasure_notes_prices) # clean and melt (reformat) dataframe

treasure_notes = graph(treasure_notes_melted, 'Market Price of Treasury Notes (1814-1817)', "Price")

treasure_notes.show()

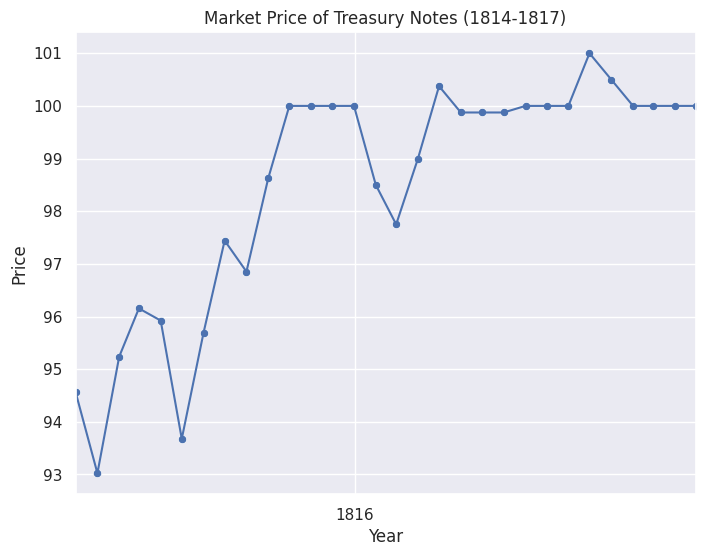

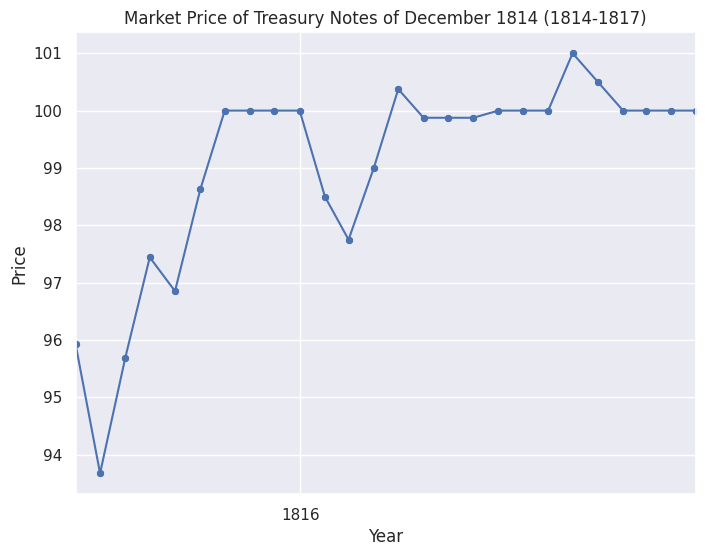

Market price data starts November, 1814. This aligns with the total outstanding records which show the first redemptions occuring in the second quarter of that year. The market price data also has a shorter date range. This is most likely due to the fact most of the Treasury notes were redeemed quickly (little more than a year) after they were issued. Price hovered around \$ 100.

Issue of 1812#

Overview and Features#

The first issue of Treasury notes were authorized by Congress on June 30, 1812. Congress decided to authorize the notes as a result of the Six Percent Loan in 1812 failing to attract enough buyers and an estimated $ 11 million deficit. Many Congressmen opposed the Treasury notes and wanted to use other revenue sources such as taxation. They argued banks and people scared of paper money would not purchase Treasury notes because they weren’t worth as much in gold or silver and that they would depreciate like the Continental Currency during the American Revolution. Meanwhile, supporters argued silver was in short supply and gold was undervalued. Therefore, coins could not be made. Treasury notes were seen as a good replacement for the First Bank of the US’s notes. Depreciation would be avoided because notes could be used to pay off taxes and banks would keep them in their reserves [3].

The act authorizing the notes states no more than $ 5 million could be issued. The interest rate was set at 5.4% and the bond could be redeemed after 1 year. Notes were sold at par. The only two denomations for the first issue were: $ 100 and $ 1000 [1].

Marketing and Buyers#

Treasury notes could be be used to pay off taxes, duties, and debts [1]. These Treasury notes could also be exchanged for long-term bonds paying 7 percent interest [2]. $3.5 million ended up being sold to banks, mostly located in Mid-Atlantic states. By December 1, the remaining bills were sold off, many going to New England. According to Treasury Secretary Alexander Dallas, Treasury notes were bought primarily by “necessitous creditors, or contractors in distress, or commissaries, quartermasters, and navy agents acting officially.” Kagin cites the Niles Weekly Register, who observed how banks primarily used the notes as reserves, meaning they were not circulating. In his report to Congress, Secretary Dallas states most notes went towards paying taxes [3].

Sources#

[1] The National Loans of the United States From July 4, 1776 to June 30, 1880 by Richard Bayley

[3] Monetary Aspects of the Treasury Notes of the War of 1812 by Donald H. Kagin

# quantities

treasure_notes_1812_quant = bond_quant[bond_quant["L1 ID"] == 20050]

clean_treasure_notes_1812_quant = clean_quant(treasure_notes_1812_quant)

# print(clean_treasure_notes_1812_quant)

total_outstanding = reformat_quant(clean_treasure_notes_1812_quant, "Total Outstanding")

#print(total_outstanding)

total_outstanding_plot = graph(total_outstanding, "Total Outstanding of Treasury Notes of 1812 (1812-1836)", "Quant")

add_marker(total_outstanding_plot, '$2.15 million redemption', "1814-4-30", 4e6, 8)

add_marker(total_outstanding_plot, '$2.74 million redemption', "1814-11-01", 1.5e6, 8)

total_outstanding_plot.show()

treasury_notes_1812_quant = total_outstanding

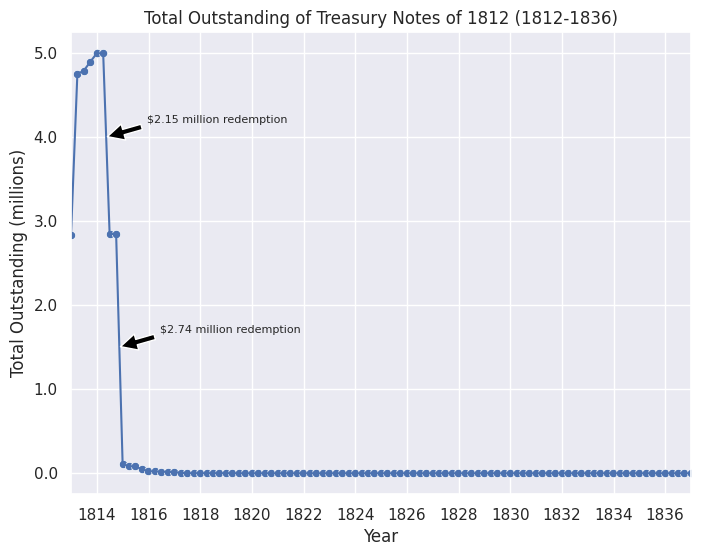

The 1812 issue of Treasury notes reached its authorized limit of $5 million by the end of 1813. The data aligns with Kagin’s statement that “the first issue of Treasury Notes was quite successful” and that “the rest of the bills were disposed of by December 1 the following year [1813].” After March 1814, the total outstanding falls sharply. By the end of 1814, the total outstanding had decreased by 97.84%. This sharp decrease aligns with the fact that Treasury notes were meant to be short-term bonds and were redeemable after a year they were issued.

Issue of 1813#

Overview and Features#

Gallatin wanted to replace the Treasury notes authorized in 1812 because the war effort required an additional borrowing of $19 million. Republicans refused to raise taxes. The $5 million in notes would be a part of the $16 million loan passed on February 8. Congress intended these notes to supplement shortfalls in long-term loans. However, Congress did nothing to support the notes in circulation and Gallatin’s plan did not succeed [2]. Madison would ask Congress for an additional $7.5 million [4].

Congress authorized the Treasury notes on February 25, 1813. They allowed the Treasury to issue no more than $5 million. The bonds sold at par. Buyers could redeem them after one year. Congress set a fixed interest rate of 5.4%. Agents earned a commission of 1/4th of a cent [1]. Congress only issued notes in $100 and $1000 denominations [3]. Congress allowed individuals to give their notes to another person [5]. While most Treasury notes were redeemed after a year, some were converted to long-term bonds with seven percent interest [6].

Marketing and Buyers#

The Treasury considered the notes as legal tender and notes could accrue short-term interest [2]. Despite the large denominations, Congress allowed individuals to give notes to each other and use notes to pay taxes, duties, and buy land. When using Treasury notes to pay, the holder earned the principal amount and accrued interest [5]. Banks used Treasury notes for their reserves. Since these early Treasury notes had high denominations and could be used as payment, wealthy Americans and merchants purchased and used them more [2].

Treasury Secretary Dallas stated in a report in 1815, the Treasury notes issued before 1815 could not be used effectively as a medium of exchange because Congress set the denominations too high ($100 and $1000), which made the early issues (before 1815) unappealing to many average individuals.

Sources#

[1] The National Loans of the United States From July 4, 1776 to June 30, 1880 by Richard Bayley

[2] Monetary Aspects of the Treasury Notes of 1812 by Donald H. Kagin

[3] Treasury notes fill gap to support War of 1812 by Paul Gilkes

[4] Financing the War of 1812 by Brandy Heritage Center

[5] An Act authorizing the issuing of Treasury notes for the service of the year one thousand eight hundred and thirteen by the Twelfth Congress

[6] American Public Finance and Financial Services 1700-1815 by Edwin J. Perkins (337)

# quantities

treasury_notes_1813_quant = bond_quant[bond_quant["L1 ID"] == 20053]

clean_treasury_notes_1813_quant = clean_quant(treasury_notes_1813_quant)

total_outstanding = reformat_quant(clean_treasury_notes_1813_quant, "Total Outstanding")

#print(total_outstanding)

total_outstanding_plot = graph(total_outstanding, "Total Outstanding of Treasury Notes of 1813 (1813-1836)", "Quant")

total_outstanding_plot.show()

public_holdings = reformat_quant(clean_treasury_notes_1813_quant, "Public Holdings")

treasury_notes_1813_quant = total_outstanding

#public_holdings_plot = graph_quant(public_holdings, "Public Holdings of Exchanged Six Percent Stock (1812-1817)")

#public_holdings_plot.show()

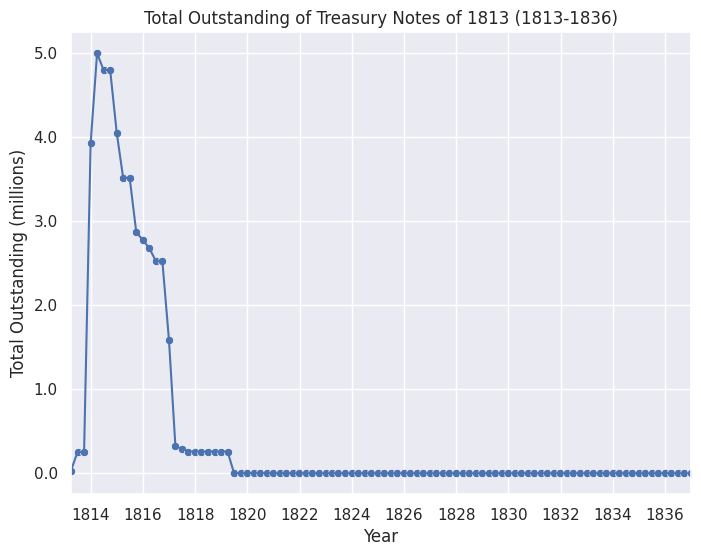

The amount of Treasury notes issued reached the maximum $5 million authorized by Congress by the end of March, 1814. In the same month, the first notes could be redeemed, after which the quantity decreased drastically over the next three years.

Issue of March, 1814#

Overview and Features#

War expenditures had ballooned to $45.4 million with Treasury revenue only at $16 million. Congress had already authorized a $25 million loan in March 4, 1814 with approximately $10 million worth of Treasury notes meant to be a part of that loan. Notes could be redeemed one year from date. The interest rate was set at 5.4% which would be paid on redemption. The notes sold at par. Similar to previous issues, these Treasury notes could be used to pay taxes, duties, or purchase public lands [1]. The notes came in three denominations: $1000, $100, and the newly added $20 [2].

Marketing and Buyers#

Agents were given a commission of 1/4th of one percent sold. The Treasury Secretary noted that the notes were popular for the following reasons: buyers were confident they would be reimbursed at the end of the year and their usefulness as a currency for what he called “remittances and other economical operations” [1]. The $20 denominations were intended to be used as hand currency so more money could end up in circulation, but the Treasury Secretary specifically avoided making the notes legal tender. Buyers also had the option of converting the notes into long-term seven percent interest bonds which helped maintain the value of the notes, unlike the Continental Currency, making them more stable and appealing [3]. In the end, large numbers of these Treasury notes would not end up in circulation as intended [2].

Sources#

[1] The National Loans of the United States From July 4, 1776 to June 30, 1880 by Richard Bayley

[2] Monetary Aspects of the Treasury Notes of the War of 1812 by Donald H. Kagin (78-79)

[3] American Public Finance and Financial Services 1700-1815 by Edwin J. Perkins (330)

# quantities

notes_1814_quant = bond_quant[bond_quant["L1 ID"] == 20055]

clean_notes_1814_quant = clean_quant(notes_1814_quant)

total_outstanding = reformat_quant(clean_notes_1814_quant, "Total Outstanding")

total_outstanding_plot = graph(total_outstanding, "Total Outstanding of Treasury Notes of March, 1814 (1814-1837)", "Quant")

total_outstanding_plot.show()

treasury_notes_march_1814_quant = total_outstanding

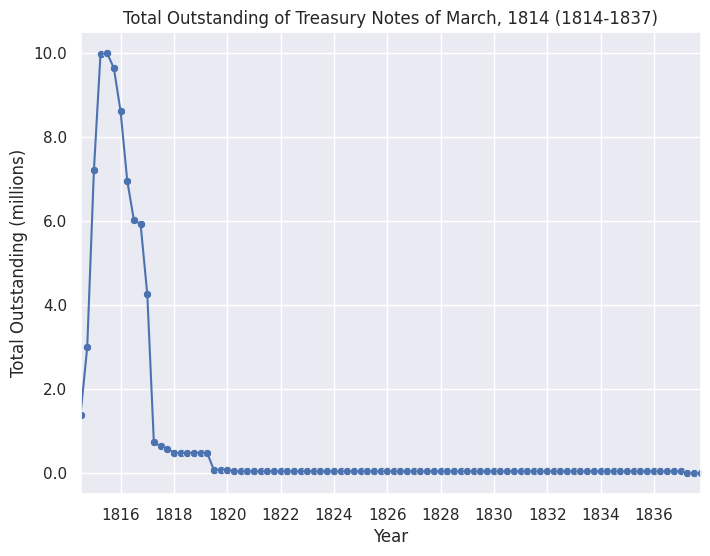

Most Treasury notes were redeemed in the latter half of 1815 and through 1816 since these Treasury notes were meant to be short-term bonds. The significant quantity of notes after 1820, relative to the previous two issues of notes, can be explained by the fact there were three denominations instead of two. By the 1830s, quantity typically decreases by $20, implying that $20 notes are still being redeemed.

Temporary Loan and Issue of December, 1814#

Overview and Features#

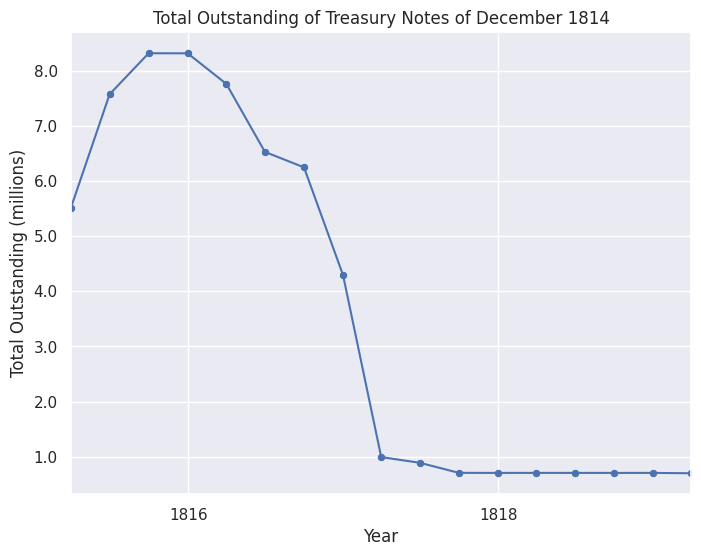

Treasury Notes: When specie payments were suspended by many banks, their notes depreciated and became unreliable. In contrast, Treasury notes, guaranteed by the United States and receivable everywhere for dues and customs, were seen as a more stable option. A bill for issuing new Treasury notes was introduced in the House of Representatives on December 5, 1814. The bill passed the House on December 8 and the Senate on December 22, with apparent ease, and was approved on December 26, 1814. The bill was titled “An act supplemental to the acts authorizing a loan for the several sums of twenty-five millions of dollars and three millions of dollars.” The act authorized the issuance of Treasury notes up to $7,500,000 in lieu of the money not yet borrowed under previous acts. It also provided for an additional $3,000,000 to cover the War Department’s expenses for 1814. The notes were to bear interest, be reimbursable, and be receivable in the same manner as those issued under the act of March 4, 1814. The act also granted the authority to employ agents to make sales of the notes. Under this act, Treasury notes amounting to $8,318,400 were issued [1].

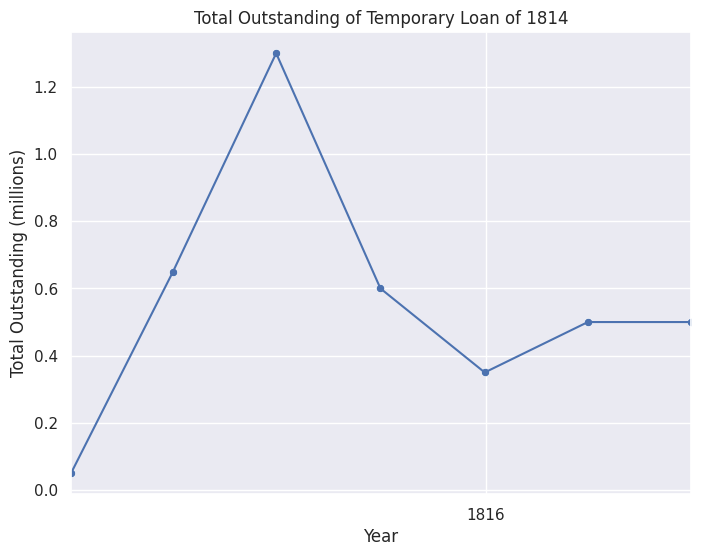

Temporary Loan: In 1814, the U.S Treasury had been provided authority to borrow $7,104,570.74 as part of the “Six per cent loans of 1814” authorized by the March 24 act. However, the loans were obtained at a substantial discount, making future loans likely to incur even greater discounts. Funds were needed to continue the war, so President James Madison called Congress to reconvene on September 19, 1814, earlier than scheduled. Despite having the authority to borrow additional funds, Congress passed an act on November 15, 1814, authorizing another loan of $3,000,000, intended specifically to cover the expenditures of the last quarter of 1814. The act allowed for the creation of stock that could be reimbursed any time after December 31, 18268. There was no limitation on the interest rate or the stock price. It also permitted the acceptance of Treasury notes due on or before January 1, 1815, at their par value, including accrued interest, for loan subscriptions [1].

Marketing and Buyers#

Treasury Notes: In terms of marketing, Treasury notes could be used to pay dues and customs, widening their appeal to include merchants and traders. A $20 and $100 were printed. The smaller denominations were meant to encourage the use of the notes as a circulating medium [2]. Based on Treasury reports, these notes were issued in the following cities: Boston, New York, Philadelphia, Baltimore, Washington, Richmond, Charleston, and Savannah. A vast majority were issued in New York and Philadelphia. Those two cities were home to a large population of merchants and bankers. Boston was another major city, but it did not buy as many notes, because New Englanders were generally opposed to the war [3].

Temporary Loan: No stock was issued under this act. Instead, $1,450,000 was borrowed from banks under special contracts [1].

[1] The National Loans of the United States From July 4, 1776 to June 30, 1880 by Richard Bayley

[2] Monetary Aspects of the Treasury Notes of the War of 1812 by Donald H. Kagin (79-80)

[3] The Funding System of the United States and of Great Britain with Some Tabular Facts of Other Nations by Jonathan Elliott

treasure_notes_1814_prices = bond_price[bond_price["L1 ID"] == 20061]

treasure_notes_melted = melt_clean_price(treasure_notes_1814_prices) # clean and melt (reformat) dataframe

treasure_notes = graph(treasure_notes_melted, 'Market Price of Treasury Notes of December 1814 (1814-1817)', "Price")

treasure_notes.show()

treasure_notes_quant=bond_quant[bond_quant["L1 ID"]==20061]

clean_treasure_notes_dec_1814_quant=clean_quant(treasure_notes_quant)

total_outstanding = reformat_quant(clean_treasure_notes_dec_1814_quant, "Total Outstanding")

total_outstanding_plot = graph(total_outstanding, "Total Outstanding of Treasury Notes of December 1814", "Quant")

treasure_notes_dec_1814_quant = total_outstanding

total_outstanding_plot.show()

temp_loan_1814_quant=bond_quant[bond_quant["L1 ID"]==20060]

clean_temp_loan_1814_quant=clean_quant(temp_loan_1814_quant)

total_outstanding = reformat_quant(clean_temp_loan_1814_quant, "Total Outstanding")

total_outstanding_plot = graph(total_outstanding, "Total Outstanding of Temporary Loan of 1814", "Quant")

total_outstanding_plot.show()

public_holdings = reformat_quant(clean_temp_loan_1814_quant, "Public Holdings")

Note: no price data for Temporary Loan of 1814

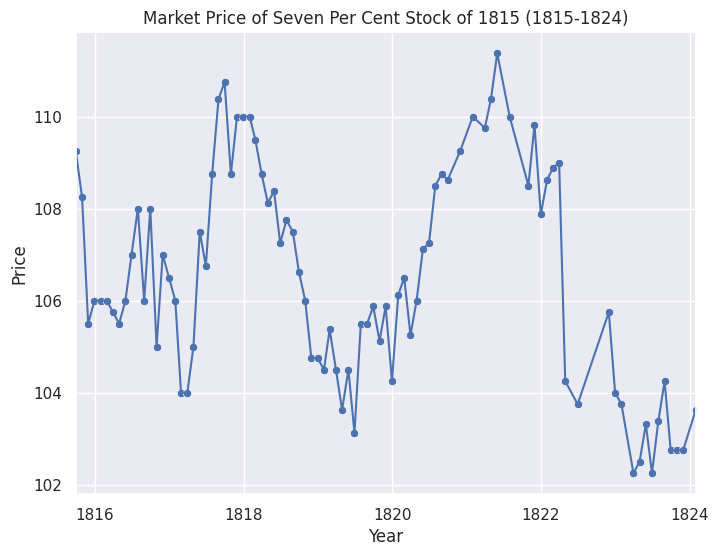

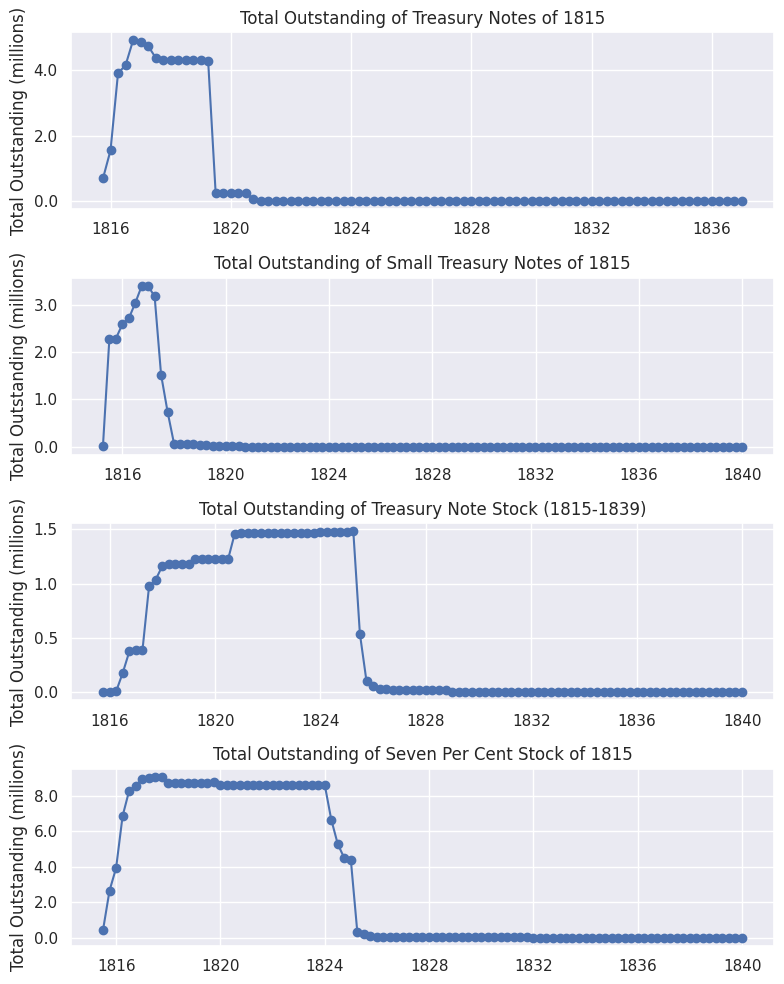

Issue of 1815, Small Treasury Notes (1815), Seven Per Cent Stock, and Treasury Note Stock (1815)#

Overview and Features:#

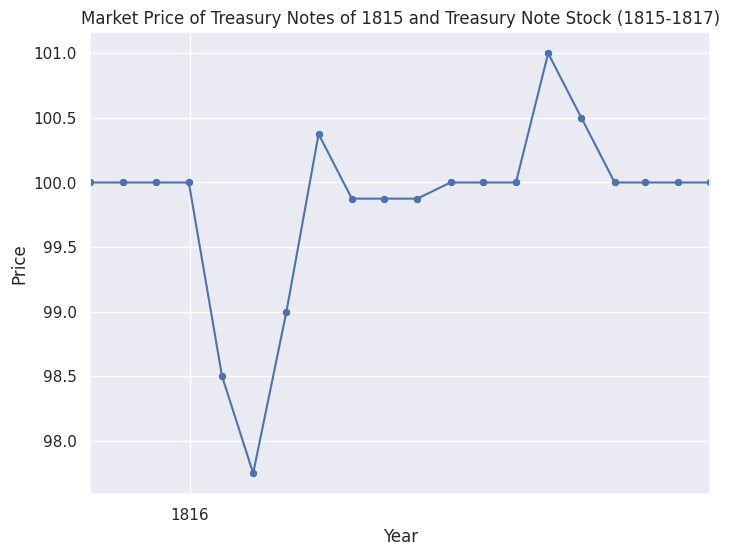

Treasury notes were issued to raise funds for the revenue deficiency and war arrearages. Initially, Congress proposed to issue $15,000,000 in notes, redeemable in five annual installments and secured by the land tax. However, the final authorization allowed for $25,000,000 in Treasury notes, as approved by the act on February 21, 1815.

Treasury notes came in two types: those less than $100, which bore no interest and were payable to the bearer, and those valued at $100 and above, which bore an interest of 5.5% and were payable to order. Notes valued at less than $100 were payable to bearer and did not bear interest, while notes valued at $100 and above bore an interest rate of 5.5% per annum and were payable to order. These notes could be presented at the treasury in exchange for certificates of funded stock, which bore 7% interest for notes under $100 and 6% interest for notes of $100 and above. The certificates were redeemable after December 31, 1824, giving holders a guaranteed return on their investment.

Marketing and Buyers#

Notes of $100 and above were transferable by delivery and endorsed assignment. These notes could be used in payments to the United States and were reissued when exchanged for funded stock or received for taxes. The notes could also be exchanged for 8 percent stock in the future. Small Treasury notes, which were notes valued at less than $100, did not bear interest themselves but could be exchanged for 7% funded stock. These notes were intended to provide a circulating medium and funding option for smaller sums, making them accessible for more transactions and exchanges. They were reissued and re-funded multiple times, eventually leading to the 7% stock amounting to $9,070,380 from an original issue of $3,392,994. For the first time, notes below $20 would be issued. These notes would not bear interest [2]. The Treasury statement provided in Elliott detail to whom the notes were issued to. A large amount of notes were issued to Robert Brent, the Paymaster-General of the US Army. The largest single buyer was William Few ($425,000). He was a former senator from Georgia and a delegate to the Constitutional Convention. He was also a successful businessman in New York [4]. Benjamin Austin was another major buyer. He was a native of Boston, where he was a merchant, and a state senator [3][5].

[1] The National Loans of the United States From July 4, 1776 to June 30, 1880 by Richard Bayley

[2] Monetary Aspects of the Treasury Notes of the War of 1812 by Donald H. Kagin (80-81)

[3] The Funding System of the United States and of Great Britain with Some Tabular Facts of Other Nations by Jonathan Elliott

treasure_notes_1815_prices = bond_price[bond_price["L1 ID"] == 20065]

treasure_notes_1815_melted = melt_clean_price(treasure_notes_1815_prices) # clean and melt (reformat) dataframe

treasure_notes_1815 = graph(treasure_notes_1815_melted, 'Market Price of Treasury Notes of 1815 and Treasury Note Stock (1815-1817)', "Price")

treasure_notes_1815.show()

treasure_notes_1815_quant=bond_quant[bond_quant["L1 ID"]==20065]

clean_treasure_notes_1815_quant=clean_quant(treasure_notes_1815_quant)

total_outstanding = reformat_quant(clean_treasure_notes_1815_quant, "Total Outstanding")

treasury_notes_1815_quant = total_outstanding

"""

total_outstanding_plot = graph(total_outstanding, "Total Outstanding of Treasury Notes of 1815", "Quant")

total_outstanding_plot.show()

"""

"""

small_treasure_notes_price = bond_price[bond_price["L1 ID"]==20066]

print(small_treasure_notes_price)

clean_small_treasure_notes_price = melt_clean_price(small_treasure_notes_price)

small_treasure_notes = graph(clean_small_treasure_notes_price, "Market Price of Small Treasury Notes of 1815", "Price")

small_treasure_notes.show()

"""

small_treasure_notes_quant=bond_quant[bond_quant["L1 ID"]==20066]

clean_small_treasure_notes_quant=clean_quant(small_treasure_notes_quant)

total_outstanding = reformat_quant(clean_small_treasure_notes_quant, "Total Outstanding")

small_treasure_notes_1815_quant = total_outstanding

"""

total_outstanding_plot = graph(total_outstanding, "Total Outstanding of Small Treasury Notes of 1815", "Quant")

total_outstanding_plot.show()

"""

treasure_note_stock_quant=bond_quant[bond_quant["L1 ID"]==20067]

clean_treasure_note_stock_quant=clean_quant(treasure_note_stock_quant)

total_outstanding = reformat_quant(clean_treasure_note_stock_quant, "Total Outstanding")

treasure_note_stock_quant = total_outstanding

"""

total_outstanding_plot = graph(total_outstanding, "Total Outstanding of Treasury Note Stock (1815-1839)", "Quant")

total_outstanding_plot.show()

public_holdings = reformat_quant(clean_small_treasure_notes_quant, "Public Holdings")

"""

Seven_Per_Cent_prices = bond_price[bond_price["L1 ID"] == 20064]

Seven_Per_Cent_melted = melt_clean_price(Seven_Per_Cent_prices) # clean and melt (reformat) dataframe

Seven_Per_Cent = graph(Seven_Per_Cent_melted, 'Market Price of Seven Per Cent Stock of 1815 (1815-1824)', "Price")

Seven_Per_Cent.show()

Seven_Per_Cent_quant=bond_quant[bond_quant["L1 ID"]==20064]

clean_Seven_Per_Cent_quant=clean_quant(Seven_Per_Cent_quant)

Seven_Per_Cent_total_outstanding = reformat_quant(clean_Seven_Per_Cent_quant, "Total Outstanding")

"""

total_outstanding_plot = graph(total_outstanding, "Total Outstanding of Seven Per Cent Stock of 1815", "Quant")

total_outstanding_plot.show()

public_holdings = reformat_quant(clean_Seven_Per_Cent_quant, "Public Holdings")

"""

'\ntotal_outstanding_plot = graph(total_outstanding, "Total Outstanding of Seven Per Cent Stock of 1815", "Quant") \ntotal_outstanding_plot.show()\npublic_holdings = reformat_quant(clean_Seven_Per_Cent_quant, "Public Holdings") \n'

# Create subplots of outstanding debt

fig, ax = plt.subplots(nrows=4, ncols=1, figsize=(8, 10))

generate_quant_plot(treasury_notes_1815_quant, "Total Outstanding of Treasury Notes of 1815", ax[0])

generate_quant_plot(small_treasure_notes_1815_quant, "Total Outstanding of Small Treasury Notes of 1815", ax[1])

generate_quant_plot(treasure_note_stock_quant, "Total Outstanding of Treasury Note Stock (1815-1839)", ax[2])

generate_quant_plot(Seven_Per_Cent_total_outstanding, "Total Outstanding of Seven Per Cent Stock of 1815", ax[3])

fig.tight_layout()

Note: no price data available regarding small treasury notes

Long-Term Bonds#

Long-term bonds typically had longer time beween issuance and redemption than notes. The long-term bonds were the first type of bonds to be issued for the war. They were meant to generate revenue to buy war supplies. Long-term bonds struggled to sell due to America’s underdeveloped securities market and the fact many banks did not trust the Treasury to repay long-term bonds. All of these problems were exacerbated by the closure of the First Bank of the US, which could no longer provide loans to the government.

Source: American Public Finance and Financial Services 1700-1815 by Edwin J. Perkins (325)

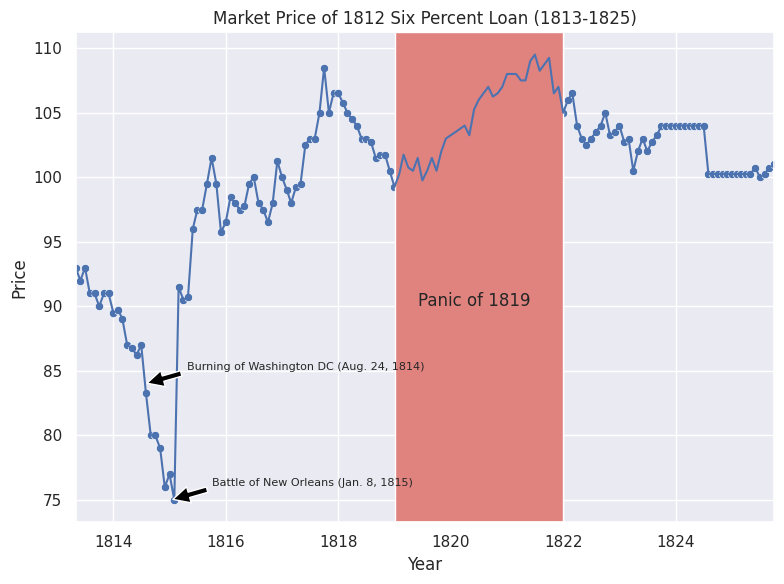

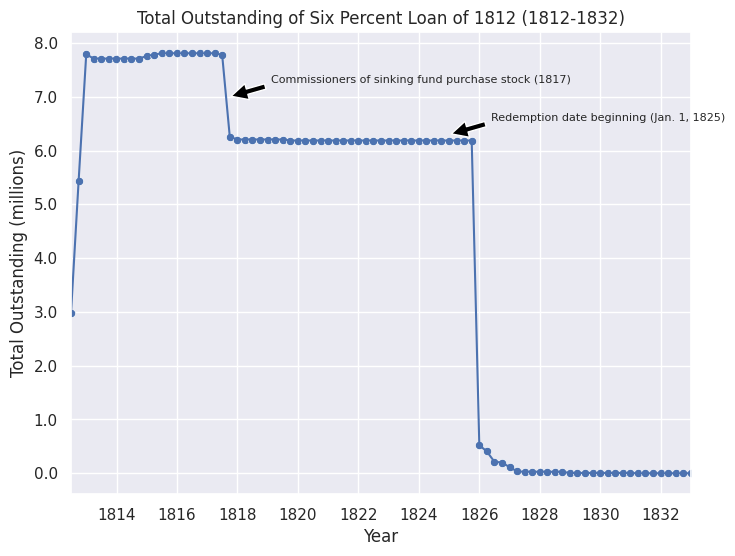

Six Percent Loan of 1812#

Overview and Features#

Six Percent Loan of 1812: Congress allowed the President to borrow no more than $11 million through an act passed on March 14, 1812, three months before the war officially began. The interest rate was set at 6%, in quarterly payments [1]. Bonds could be redeemed starting January 1, 1825. Bonds could not be sold below par. The treasury obtained $8,134,700 through issuing these stock certificates [1].

Temporary Loan of 1812: Authorized by the same act on March 14, 1812 that authorized the Six Percent Loan of 1812. Bonds were redeemable based on contracts. Sold at par and at 6% interest in quarterly payments. The final redemption occured on June 28, 1817. Around $2,150,000 was obtained under special contracts with various banks according to Bayley [1].

Exchanged Six Percent Stock: Congress authorized the exchanged six percent stock through an act on June 24, 1812. The act allowed individuals to trade in their old six percent stock in exchange for new six percent stock. These new stocks had the same features as the original stock. Gallatin had noted that by June, the $11 million loan only managed to bring in $6.46 million. Gallatin thought this new stock would increase the price of the bonds since, according to Gallatin, the old stock was selling 2-3% below par. The Treasury collected around $2,984,746 worth of subscriptions of the exchanged six percent stock. The act did not have any new features compared to the old six percent stock. The act explicitly protected those who purchased the old six percent stock and did not wish to subcribe to the exchanged stock. The only individuals and banks who could purchase the new six percent stocks were those who already had the old six percent stock [1].

Marketing and Buyers#

Not many banks and individuals were interested in buying government debt and the modest interest rate (6%) did not excite many potential buyers. Another reason Potential buyers did not buy the six percent stock was because they were nervous that the United States could suffer defeat against Britain, who had the largest army and navy at the time. New Englanders remained unsympathetic to the war and Congress did not find a way to fulfill interest payments, which did not raise confidence. Meanwhile, securities markets were primarily regional, located in major cities such as New York. American firms lacked the ability to underwrite large securities issues, and American agents in Europe could not underwrite American securities issues. Due to the lack of capability, the Treasury announced the six percent bonds and simply waited for investors to come, but only $6.2 million was initially bought [2].

$4.2 million bought by banks for their long-term portfolios.

$2.0 million bought by individuals [2].

Sources#

[1] The National Loans of the United States From July 4, 1776 to June 30, 1880 by Richard Bayley

[2] American Public Finance and Financial Services 1700-1815 by Edwin J. Perkins (327-330)

# Six percent loan of 1812

# prices

six_percent_prices = bond_price[bond_price["L1 ID"] == 20048]

six_percent_prices_melted = melt_clean_price(six_percent_prices) # clean and melt (reformat) dataframe

six_percent_plot = graph(six_percent_prices_melted, 'Market Price of 1812 Six Percent Loan (1813-1825)', "Price")

# historical annotations

add_marker(six_percent_plot, 'Burning of Washington DC (Aug. 24, 1814)', "1814-7-24", 84, 8)

add_marker(six_percent_plot, 'Battle of New Orleans (Jan. 8, 1815)', "1815-1-08", 75, 8)

# Panic of 1819

add_period(six_percent_plot, "1819", "1822")

six_percent_plot.text(pd.Timestamp("1820-06"), 90, 'Panic of 1819', horizontalalignment='center')

six_percent_plot.tight_layout()

six_percent_plot.savefig("six_percent_loans.png")

six_percent_plot.show()

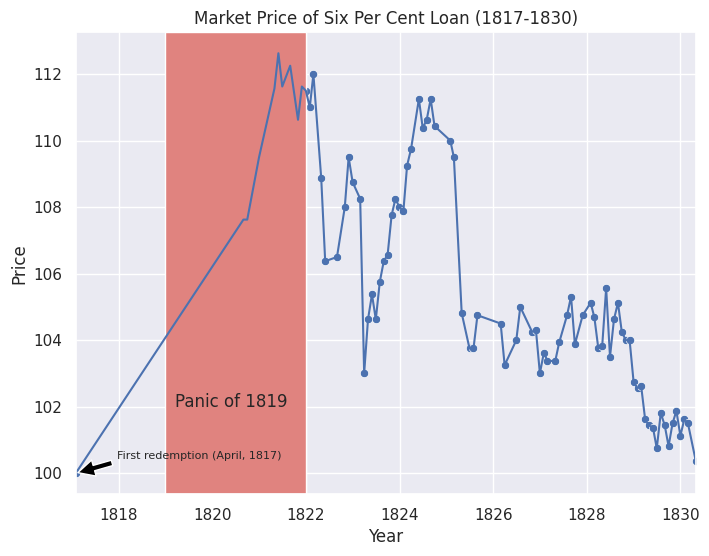

Prices dipped substantially during the latter half of 1814. From the end of June, 1814 to the end of January, 1815, prices decreased by 13.79%. The decrease in price coincides with the British Chesapeake campaign which saw the burning of Washington DC. However, it can mainly be explained by the decrease in trade during the war. The uptick in prices after January, 1815 can be explained by the signing of the Treaty of Ghent, ending the war and the resumption of trade. The market price reached a maximum of $109.50 by the end of June, 1822. The period from 1819 to the latter half of 1822 saw an increase in the price, coinciding with the Panic of 1819 and the ensuing financial crisis. The rise in prices during this time could be explained by the Second Bank’s tighter monetary policy that reduced the money supply. This deflation would have in turn led to a rise in bond prices.

# quantities

six_percent_quant = bond_quant[bond_quant["L1 ID"] == 20048]

clean_six_percent_quant = clean_quant(six_percent_quant)

#print(clean_six_percent_quant)

total_outstanding = reformat_quant(clean_six_percent_quant, "Total Outstanding")

six_percent_1812_quant = total_outstanding

#print(total_outstanding)

total_outstanding_plot = graph(total_outstanding, "Total Outstanding of Six Percent Loan of 1812 (1812-1832)", "Quant")

# add historical dates

add_marker(total_outstanding_plot, 'Commissioners of sinking fund purchase stock (1817)', "1817-9-20", 7e6, 8)

add_marker(total_outstanding_plot, 'Redemption date beginning (Jan. 1, 1825)', "1825-1-01", 6.3e6, 8)

total_outstanding_plot.show()

Total outstanding of approximately 3 million at the end of June 1813. By the end of 1813, total oustanding increases to 7.7 million. Slight uptick at the end of 1814, at the war’s conclusion. Quantity drops from 7.78 million to 6.26 million between July and September of 1817; 19.57% decrease (-$1,522,048); according to Bayley, the commissioners of the sinking fund purchased $1,603,997 at that time. There was a 91.57% decrease in total outstanding from October to December 1825; most likely cause were that bonds became redeemable starting January, 1825. The maximum quantity outstanding was

$7,810,500, way below the $11 million authorized by Congress.

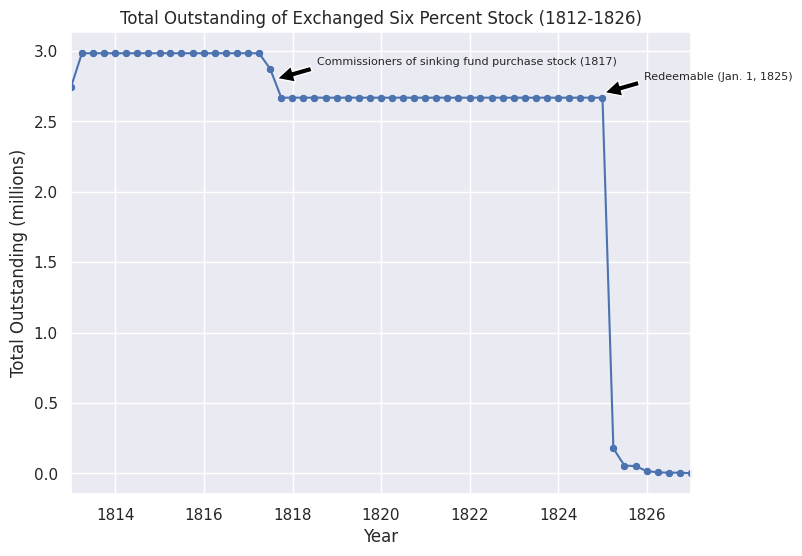

# quantities

exchanged_six_quant = bond_quant[bond_quant["L1 ID"] == 20051]

clean_exchanged_six_quant = clean_quant(exchanged_six_quant)

total_outstanding = reformat_quant(clean_exchanged_six_quant, "Total Outstanding")

#print(total_outstanding)

total_outstanding_plot = graph(total_outstanding, "Total Outstanding of Exchanged Six Percent Stock (1812-1826)", "Quant")

add_marker(total_outstanding_plot, 'Redeemable (Jan. 1, 1825)', "1824-12-31", 2.7e6, 8)

add_marker(total_outstanding_plot, 'Commissioners of sinking fund purchase stock (1817)', "1817-8-10", 2.8e6, 8)

total_outstanding_plot.show()

public_holdings = reformat_quant(clean_exchanged_six_quant, "Public Holdings")

exchanged_six_quant = total_outstanding

There is a sharp decrease in total outstanding from December, 1824 through March, 1825 from $2,668,974.99 to $177,650.18, a 93.34% decrease. The decrease was most likely caused by the fact that the stock became redeemable after December 31, 1824.

Sixteen Million Loan of 1813#

Overview and Features#

Congress authorized the $16 million loan on February 8, 1813. The loan was necessary since Treasury notes and import duties failed to cover war expenses. The interest rate was set at 6%, payable quarterly. Bonds would be redeemable after January 1, 1826. They sold at 88 percent face value. $18,109,377.43 was issued [1].

Marketing and Buyers#

Banking institutions did not buy the bonds. Potential buyers were scared of America losing the war. By March, the loan had a shortfall of $10 million. Therefore, Gallatin began relying on wealthy individuals to make up for the deficit.

Stephen Girard: He was a French native, banker, and financier. He operated a private bank in Philadelphia out of the First Bank of the US building. He remained friends with Secretary Gallatin. He agreed to help make up for the $10 million shortfall. His decision increased public confidence [2].

David Parish: He was an agent of a Philadelphia banking house and part of Parish and Company, a firm from Hamburg, Germany. He had experience in underwriting securities and forming syndicates [4]. He made most of his wealth from land speculation [3].

John Jacob Astor: He was an immigrant from Germany who lived in New York City. He made his money from the fur trade, selling opium to China, and real estate. He was the first member of the powerful Astor family to live in America [4]. He was also one of the richest men in America [5].

Girard, Parish, and Astor agreed to form a syndicate. They purchased $10.1 million worth of 6 percent bonds at $88 discounted. Girard and Parish’s personal shares were $3.1 million and Astor’s was $1.5 million. The three syndicate members hired at least seven firms from Phildadelphia, New York, and Baltimore to purchase the remaining $2.4 million. The syndicate did not bear any financial risk and they would market their combined total of $7.7 million, earning $11,510 in commissions [4].

Sources#

[1] The National Loans of the United States From July 4, 1776 to June 30, 1880 by Richard Bayley

[2] Girard to the Rescue: Stephen Girard and the War Loan of February 8, 1813 by Mark T. Hensen

[3] David Parish

[4] American Public Finance and Financial Services 1700-1815 by Edwin J. Perkins (331)

[5] John Jacob Astor

# Sixteen million loan of 1813

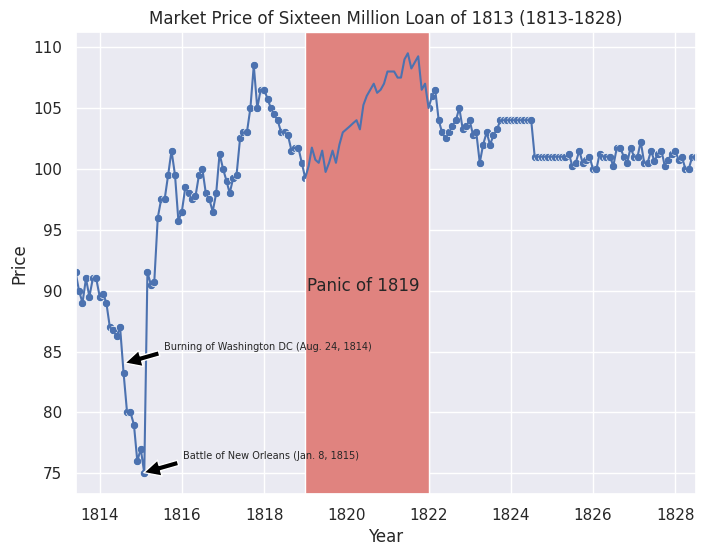

sixteen_mil_prices = bond_price[bond_price["L1 ID"] == 20052]

sixteen_mil_melted = melt_clean_price(sixteen_mil_prices) # clean and melt (reformat) dataframe

sixteen_mil = graph(sixteen_mil_melted, 'Market Price of Sixteen Million Loan of 1813 (1813-1828)', "Price")

# historical annotations

add_marker(sixteen_mil, 'Burning of Washington DC (Aug. 24, 1814)', "1814-7-24", 84, 7)

add_marker(sixteen_mil, 'Battle of New Orleans (Jan. 8, 1815)', "1815-1-08", 75, 7)

# Panic of 1819

add_period(sixteen_mil, "1819", "1822")

sixteen_mil.text(pd.Timestamp("1820-06"), 90, 'Panic of 1819', horizontalalignment='center')

sixteen_mil.show()

The market price for 1813 six percent bonds is almost identical to the 1812 six percent stock (old and exchanged); these bonds traded at the same time. There are differences. The data for the 1813 bonds begins one month later (in June compared to May for the 1812 bonds). The data continues the 1812 six percent since the 1813 bonds were redeemable a year (1826) later than the 1812 six percent bonds (1825).

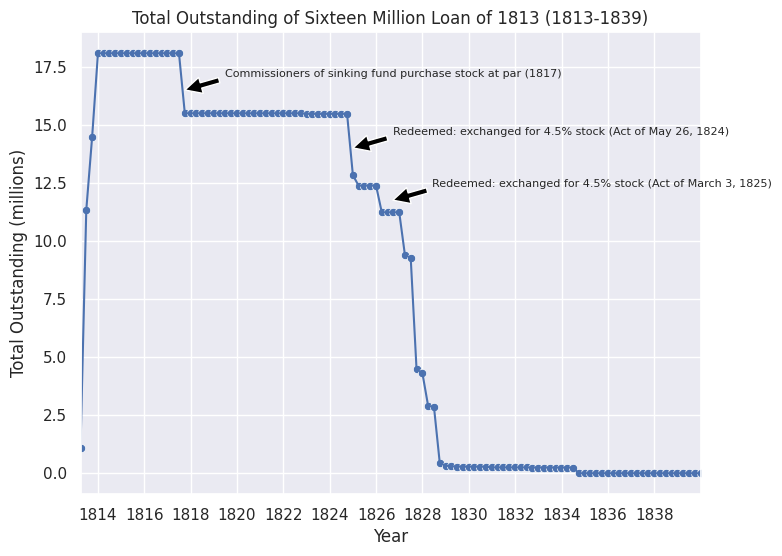

# quantities

sixteen_mil_quant = bond_quant[bond_quant["L1 ID"] == 20052]

clean_sixteen_mil_quant = clean_quant(sixteen_mil_quant)

total_outstanding = reformat_quant(clean_sixteen_mil_quant, "Total Outstanding")

# print(total_outstanding)

total_outstanding_plot = graph(total_outstanding, "Total Outstanding of Sixteen Million Loan of 1813 (1813-1839)", "Quant")

add_marker(total_outstanding_plot, 'Commissioners of sinking fund purchase stock at par (1817)', "1817-8-30", 16.5e6, 8)

add_marker(total_outstanding_plot, 'Redeemed: exchanged for 4.5% stock (Act of May 26, 1824)', "1824-11-30", 14e6, 8)

add_marker(total_outstanding_plot, 'Redeemed: exchanged for 4.5% stock (Act of March 3, 1825)', "1826-8-20", 11.75e6, 8)

total_outstanding_plot.show()

sixteen_mil_quant = total_outstanding

A total of $18,109,377 million was issued. The additional $2,109,377.43 came from the fact the bond was sold at a discount. The decrease in total outstanding from June to September 1817 overlaps with a decrease in total outstanding during that same time period for the 1812 six percent bonds (-$2,580,943.7). According to Bayley, in 1817, the commissioners of the sinking fund purchased $2,580,943.7 at par. For the other decreases in the years following, acts by Congress in 1822, 1824, and 1825 saw the amount redeemed exchanged for new interest-bearing stocks.

Seven and One-Half Million Loan of 1813#

Overview and Features#

Congress authorized a loan of $7.5 million on August 2, 1813. The bonds sold at 88.25% face value, a discount. They could not be sold less than $88. Buyers could redeem them after Jan. 1, 1826. Congress set a fixed interest rate of 6% and interest paid quarterly [1].

Secretary of the Navy William Jones became acting Treasury Secretary in May, 1814. Jones requested a long-term loan because he feared that Treasury notes could depreciate [1]. Congress set aside $ 8 million for interest payments and reimbursement [2]. Jones sold $8.5 million worth of the bonds at a discount. Gallatin stated the bonds sold quicker than the $ 16 million loan in 1812 [3]. According to Jones, the entire loan had been subscribed by the first months of 1814 [3]. The final redemption occurred on August 2, 1845 [1].

Marketing and Buyers#

Agents earned a commission of 1/4th of a cent [1]. The commission provided an incentive for individuals and banks to market the loan. The bond sold at a ~12% discount to try and attract more buyers. New England was not considered a willing market for these bonds due to opposition to the war. Southern states, south of Baltimore, did not have properly organized capital markets to facilitate these bonds. The government chose not to ask for help from outside financiers such as Girard, Astor, or Parish [4]. According to the Treasury’s annual financial reports, the largest purchaser of bonds from this loan was once again Jonathan Smith. He was a lawyer and the Treasury records in 1817 list him as a cashier at the Second Bank of the US [5].

Sources#

[1] The National Loans of the United States From July 4, 1776 to June 30, 1880 by Richard Bayley

[2] An Act authorizing a loan for a sum not exceeding seven millions five hundred thousand dollars. by Thirteenth Congress

[3] The Financial History of the War of 1812 by Lisa R. Morales

[4] American Public Finance and Financial Services 1700-1815 by Edwin J. Perkins (332)

[5] Report on the Finances, December 1817 by Department of the Treasury

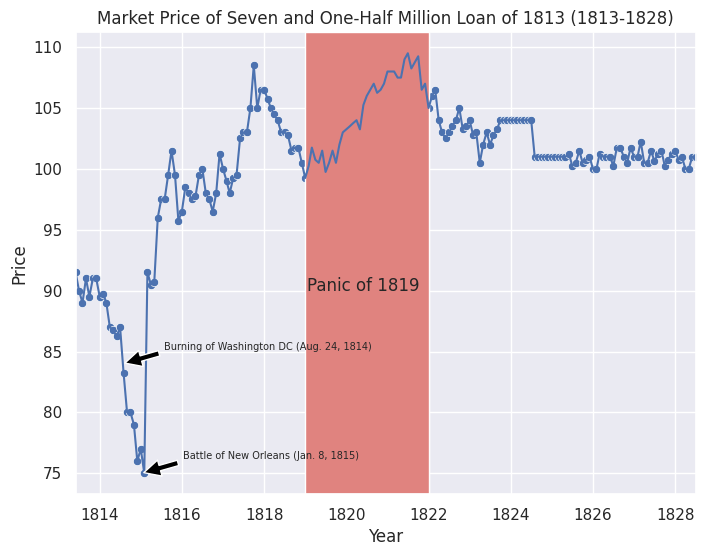

# seven and one-half million loan of 1813

seven_one_half_prices = bond_price[bond_price["L1 ID"] == 20054]

seven_one_half_melted = melt_clean_price(seven_one_half_prices) # clean and melt (reformat) dataframe

seven_one_half = graph(seven_one_half_melted, 'Market Price of Seven and One-Half Million Loan of 1813 (1813-1828)', "Price")

# historical annotations

add_marker(seven_one_half, 'Burning of Washington DC (Aug. 24, 1814)', "1814-7-24", 84, 7)

add_marker(seven_one_half, 'Battle of New Orleans (Jan. 8, 1815)', "1815-1-08", 75, 7)

# Panic of 1819

add_period(seven_one_half, "1819", "1822")

seven_one_half.text(pd.Timestamp("1820-06"), 90, 'Panic of 1819', horizontalalignment='center')

seven_one_half.show()

The market price of the bonds were identical to the previous Sixteen Million Loan of 1813. These bonds shared the same features and redemption date. Therefore, they must have traded together.

# quantities

seven_one_half_quant = bond_quant[bond_quant["L1 ID"] == 20054]

clean_seven_one_half_quant = clean_quant(seven_one_half_quant)

#print(clean_seven_one_half_quant)

total_outstanding = reformat_quant(clean_seven_one_half_quant, "Total Outstanding")

#print(total_outstanding)

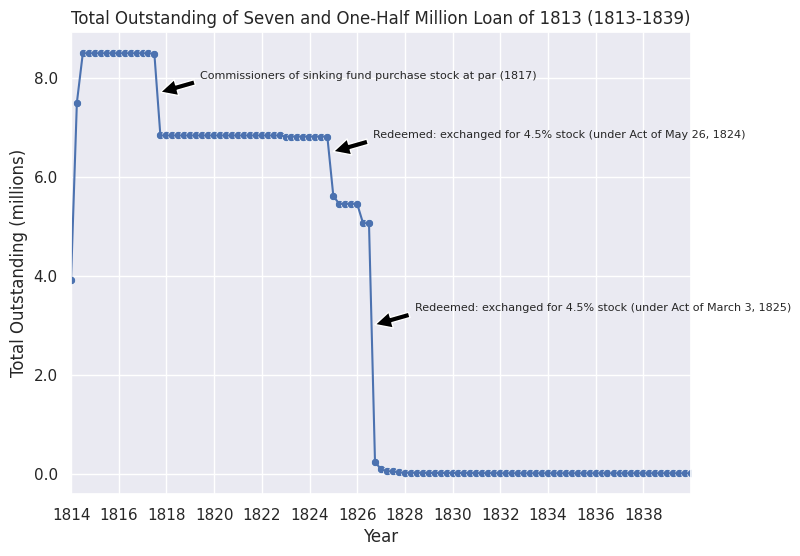

total_outstanding_plot = graph(total_outstanding, "Total Outstanding of Seven and One-Half Million Loan of 1813 (1813-1839)", "Quant")

add_marker(total_outstanding_plot, 'Commissioners of sinking fund purchase stock at par (1817)', "1817-8-30", 7.7e6, 8)

add_marker(total_outstanding_plot, 'Redeemed: exchanged for 4.5% stock (under Act of May 26, 1824)', "1824-11-30", 6.5e6, 8)

add_marker(total_outstanding_plot, 'Redeemed: exchanged for 4.5% stock (under Act of March 3, 1825)', "1826-8-30", 3e6, 8)

total_outstanding_plot.show()

public_holdings = reformat_quant(clean_seven_one_half_quant, "Public Holdings")

seven_one_half_quant = total_outstanding

#public_holdings_plot = graph_quant(public_holdings, "Public Holdings of Exchanged Six Percent Stock (1812-1817)")

#public_holdings_plot.show()

The total outstanding follows a similar trend to the two previous long-term six percent bonds. There is a decrease in total oustanding from June to September, 1817. This aligns with Bayley’s note that the comissioners of the sinking fund purchased \$ 1,662,349.56 at par during the same time period. The commissioners of the sinking fund also purchased large amounts of the two previous long-term bonds during the same time. The decreases in total oustanding in 1824, 1825, and 1826 were due to acts of Congress that exchanged the amount redeemed for new 4.5% stock. Congress didn’t want to pay the 6% stocks that were due in 1826 since the amount was too great. Therefore, they offered these new 4.5% stock payable in 1829 and 1830 to lessen the burden of themselves. However, these new stocks turned out to be a failure, with only one-tenth being sold of what was expected.

Source: The 1825 Stock Exchange Flop

Six Percent Loans of 1814#

Overview and Features#

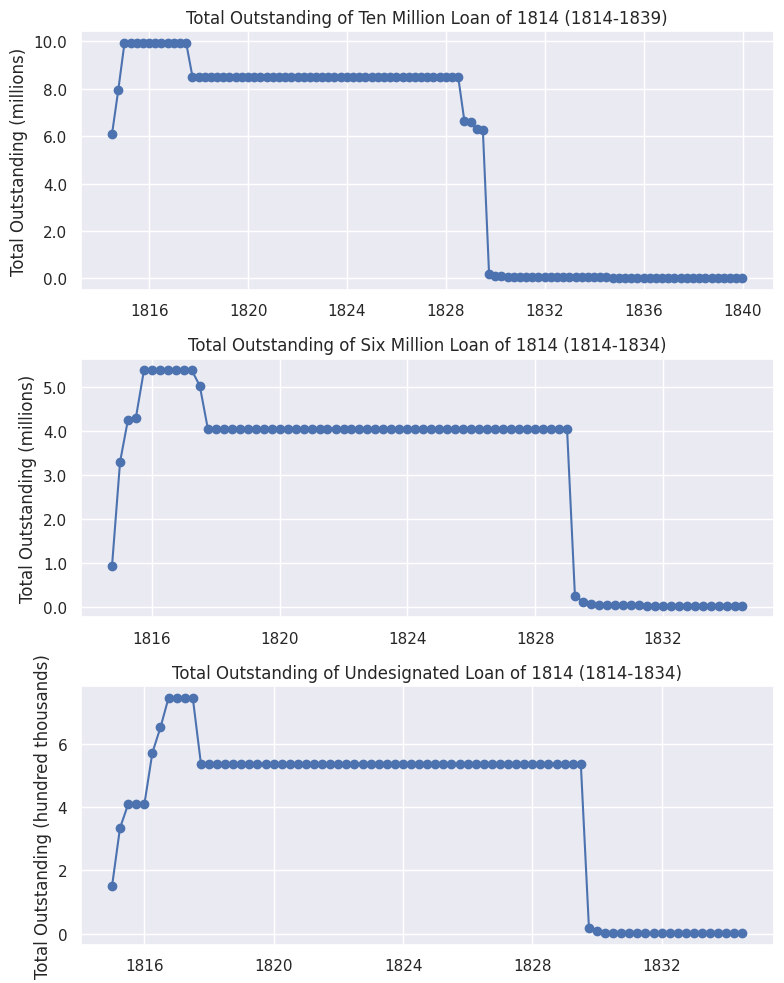

In 1814, the Treasury reported an estimated $29.4 million deficit. In addition, previous funds raised from bonds in 1813 had all been used up in fighting in Canada. Therefore, Congress authorized a long-term loan of $25 million on March 24, 1814. Different amounts of the loan would be raised at different times in the hopes of getting more subscribers [1].

Ten Million Stock: Redeemable after December 31, 1826. It sold at a discount of 80 percent face value. Interest rate was set at 6 percent with quarterly payments on January, April, July, and October. Agents received a commission of 1/4th of one cent sold. Congress appropriated $ 8 million to reimburse and pay interest on the loan. Amount of Stock Issued (Ten Million Loan): $9,919,476.25 [1].

Six Million Stock: Same features as the Ten Million Stock. Amount of Stock Issued (Six Million Loan): $5,384,134.87 [1].

Undesignated Stock For the most part, the same features as the Six Million and Ten Million Stock. However, stocks sold anywhere between 80-95% face value. Amount of Stock Issued (Undesignated Loan): $746,403.31 [1].

Marketing and Buyers#

Ten Million Loan: Treasury Secretary George W. Campbell realized he would struggle to raise $25 million at once. He decided to raise $10 million first. He received offers totaling $11.9 million without relying on loan contractors. He sold $9.2 million at $88 per subscription. He ignored the remaining $2.7 million since they offered less per subscription [1][2]. Jacob Barker, a successful New York merchant, purchased $5 million worth of bonds (half of the total 10 million). Barker used a leveraged transaction to buy them; Barker sought loans from banks in the northeast to purchase the bonds and used the bonds as collateral [2].

Six Million Loan: A new proposal of $6 million was offered beginning July 25, 1814. Bonds were sold at a discount of 20 percent. Due to the discount, the Treasury offered a rebate to the original buyers of the Ten Million Loan at a rate of $10 per hundred of stock held. Thus, the Treasury protected initial buyers from the price decrease. Agents earned commissions of 1/4th of one percent on any subscriptions over $25000 [1]. Six Philadelphia banks took $250,000 for Philadelphia’s military defenses. Seven Baltimore banks took $675,000 for their city’s defenses [1]. British forces would capture Washington DC that August and launch an assault on Baltimore in September [5]. The corporation of New York City subscribed to $1,100,000.87 worth of stocks for supplies and reinforcements of the city. Bayley also mentions the Baltimore committee of vigilance and safety and the Planters’ Bank of Savannah as buyers [1]. Overall, the six million stock failed to sell due to the British invasion during the Chesapeake Campaign. Therefore, $3 million were sent to Europe for sale, most likely to David Parish in Hamburg, Germany [2].

Undesignated Loan: Subscriptions were obtained through contracts with corporations and banks. The contracts would have allowed specific terms to be negotiated, such as selling price. Several corporations in Baltimore subscribed to $150,000 of bonds to build a steam frigate to defend the city’s port. The Bank of Pennsylvania subscribed to $43,222. The Bank of Columbia subscribed to $25000 and $100,000 from the Mechanics’ Bank of Alexandria.

Bank of Columbia: located in the Washington DC (District of Columbia)

Bank of Pennsylvania: established in 1793 and located in Philadelphia [4].

Mechanics’ Bank of Alexandria: chartered by Congress [2]; first incorporated in Alexandria, Virginia by an act of Congress in 1812 [3].

Sources#

[1] The National Loans of the United States From July 4, 1776 to June 30, 1880 by Richard Bayley

[2] American Public Finance and Financial Services 1700-1815 by Edwin J. Perkins (334)

[3] An Act to incorporate a Bank in the town of Alexandria, by the name and style of the Mechanics’ Bank of Alexandria by Twelfth Congress

[4] A History of Pennsylvania. Penn State Press. by Philip Shriver Klein and Ari Hoogenboom (273)

# 10 mil loan of 1814

six_percent_prices = bond_price[bond_price["L1 ID"] == 20056]

six_percent_melted = melt_clean_price(six_percent_prices) # clean and melt (reformat) dataframe

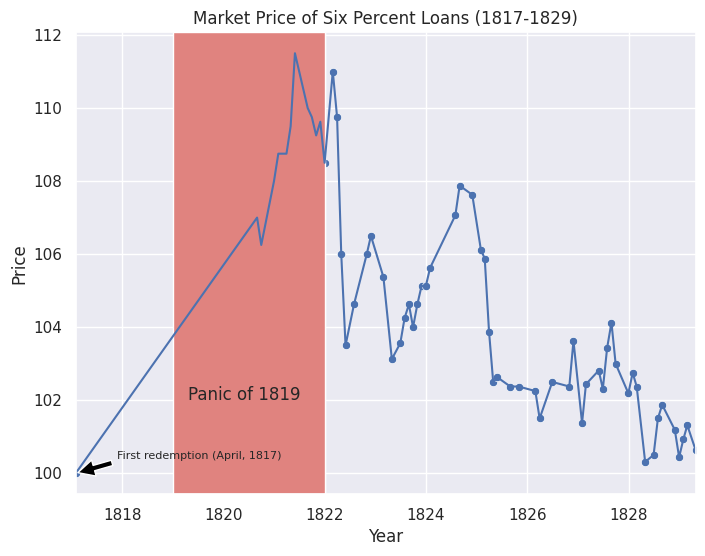

six_percent = graph(six_percent_melted, "Market Price of Six Percent Loans (1817-1829)", "Price")

add_marker(six_percent, 'First redemption (April, 1817)', "1817-1-31", 100, 8)

# Six Percent Loans of 1814

add_period(seven_one_half, "1819", "1822")

seven_one_half.text(pd.Timestamp("1820-06"), 102, 'Panic of 1819', horizontalalignment='center')

six_percent.show()

Since all three stocks were technically issued as part of one larger $ 25 million loan, the market price of all three bonds are the same.

# ten million loan

ten_mil_quant = bond_quant[bond_quant["L1 ID"] == 20056]

ten_mil_quant = clean_quant(ten_mil_quant)

ten_mil_quant = reformat_quant(ten_mil_quant, "Total Outstanding")

# six million loan

six_mil_1814_quant = bond_quant[bond_quant["L1 ID"] == 20057]

six_mil_1814_quant = clean_quant(six_mil_1814_quant)

six_mil_1814_quant = reformat_quant(six_mil_1814_quant, "Total Outstanding")

# undesignated loan

undesignated_1814_quant = bond_quant[bond_quant["L1 ID"] == 20058]

undesignated_1814_quant = clean_quant(undesignated_1814_quant)

undesignated_1814_quant = reformat_quant(undesignated_1814_quant, "Total Outstanding")

# Create subplots of outstanding debt

fig, ax = plt.subplots(nrows=3, ncols=1, figsize=(8, 10))

generate_quant_plot(ten_mil_quant, "Total Outstanding of Ten Million Loan of 1814 (1814-1839)", ax[0])

generate_quant_plot(six_mil_1814_quant, "Total Outstanding of Six Million Loan of 1814 (1814-1834)", ax[1])

generate_quant_plot(undesignated_1814_quant, "Total Outstanding of Undesignated Loan of 1814 (1814-1834)", ax[2])

fig.tight_layout()

# Group six percent loans quantities into one dataframe

six_percent_loans_1814 = pd.concat([ten_mil_quant.copy(), six_mil_1814_quant.copy(), undesignated_1814_quant.copy()])

six_percent_loans_1814.reset_index(drop=True, inplace=True)

# Merge rows with the same timestamps, add Quants

six_percent_loans_1814_quant = six_percent_loans_1814.groupby("Timestamp", as_index=False).aggregate({"Quant":"sum"})

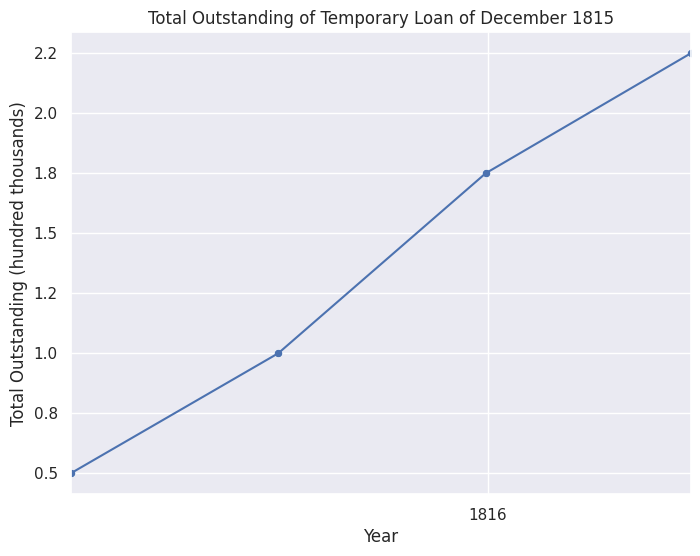

Temporary Loan of 1815#

Overview and Features#

The Temporary Loan of 1815 was necessitated by the damage inflicted on public buildings in Washington, D.C., during a British incursion on the night of August 24, 1814. The White House was burned, and the Capitol building was seriously damaged. The British forces attempted to set fire to the Capitol but were unable to cause extensive damage due to the building’s solid construction and their limited time in the city. The next session of Congress was held in a temporary building on First Street, known as the “Old Capitol.” During this session, a bill was introduced to repair or rebuild the Capitol, the White House, and other public buildings. This bill authorized a loan of $500,000 at an interest rate not exceeding 6%, from any bank or individual within the District of Columbia. The bill was approved on February 13, 1815 (3 Statutes, 205) [1].

Marketing and Buyers#

All $225,000 that were issued were borrowed from the banks in the DC [1].

[1] The National Loans of the United States From July 4, 1776 to June 30, 1880 by Richard Bayley

feb_temp_loan_quant=bond_quant[bond_quant["L1 ID"]==20063]

clean_feb_temp_loan_quant=clean_quant(feb_temp_loan_quant)

total_outstanding = reformat_quant(clean_feb_temp_loan_quant, "Total Outstanding")

temp_loan_1815_quant = total_outstanding

total_outstanding_plot = graph(total_outstanding, "Total Outstanding of Temporary Loan of December 1815", "Quant")

total_outstanding_plot.show()

public_holdings = reformat_quant(clean_feb_temp_loan_quant, "Public Holdings")

The Six Percent Loan of 1815#

Overview and Features#

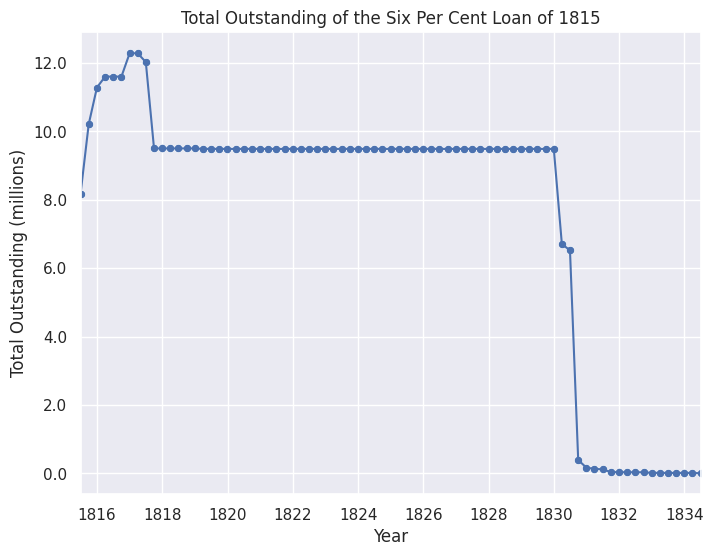

At the close of 1814, the United States faced a significant war debt, with large sums either due or rapidly approaching maturity. This debt consisted of temporary loans and treasury notes issued under various acts. Although the end of the war suggested that revenue might increase due to the revival of commerce, the immediate influx of funds was delayed by the existing credit system. The Loan Act of 1815 was introduced and passed with remarkable speed. Approved on March 3, 1815, the act authorized the President to borrow up to $18,452,800. This borrowing aimed to redeem Treasury notes charged to the sinking fund and address the outstanding war debt. The act stipulated that the borrowed funds could be reimbursed after twelve years from December 31, 1827. The surplus of the sinking fund was pledged for both interest payments and principal repayment. Additionally, the act permitted banks in the District of Columbia to lend portions of the authorized sum, overriding any contrary provisions in their charters. Treasury notes issued prior to the act’s passage were accepted for loan subscriptions, and interest on due and unpaid Treasury notes was authorized until funds for their payment were assigned. The outcome of the act was the issuance of stock certificates totaling $12,288,147.50, for which $11,699,320.03 was received in cash, reflecting an average discount of 4.75%. Redemption of this stock began in 1817 and was completed by 1835. Additionally, a temporary loan of $1,150,000 was secured at par, making the total debt contracted under the act $13,438,147.56, with $12,849,320.03 received in cash [1].

Marketing and Buyers#

To facilitate the loan, the act allowed for the employment of agents who could receive a commission of up to 0.25%, with $30,000 allocated for these commissions [1]. All buyers of the loan are listed in the Treasury reports put together by Elliott. There were many buyers. The biggest purchaser was D.A. Smith from Baltimore ($1 million). He was a merchant, banker, and shipowner. He was also a director of the Second Bank of the US [2]. Jonathan Smith from Philadelphia purchased the same amount ($1 million). He was also a major purchaser of the Seven One-Half Million Loan. Not much is known about him, except that he was a lawyer [3].

[1] The National Loans of the United States From July 4, 1776 to June 30, 1880 by Richard Bayley

[3] The Funding System of the United States and of Great Britain with Some Tabular Facts of Other Nations by Jonathan Elliott

six_per_cent_loan_prices = bond_price[bond_price["L1 ID"] == 20069]

six_per_cent_loan_melted = melt_clean_price(six_per_cent_loan_prices)

six_per_cent_loan = graph(six_per_cent_loan_melted, 'Market Price of Six Per Cent Loan (1817-1830)', "Price")

# Six Percent Loans of 1815

add_marker(six_percent, 'First redemption (April, 1817)', "1817-1-31", 100, 8)

add_period(six_per_cent_loan, "1819", "1822")

six_per_cent_loan.text(pd.Timestamp("1820-06"), 102, 'Panic of 1819', horizontalalignment='center')

six_per_cent_loan.show()

six_per_cent_loan_quant=bond_quant[bond_quant["L1 ID"]==20069]

clean_six_per_cent_loan_quant=clean_quant(six_per_cent_loan_quant)

total_outstanding = reformat_quant(clean_six_per_cent_loan_quant, "Total Outstanding")

six_percent_loan_1815_quant = total_outstanding

total_outstanding_plot = graph(total_outstanding, "Total Outstanding of the Six Per Cent Loan of 1815", "Quant")

total_outstanding_plot.show()

public_holdings = reformat_quant(clean_six_per_cent_loan_quant, "Public Holdings")

Visualizing Total Oustanding#

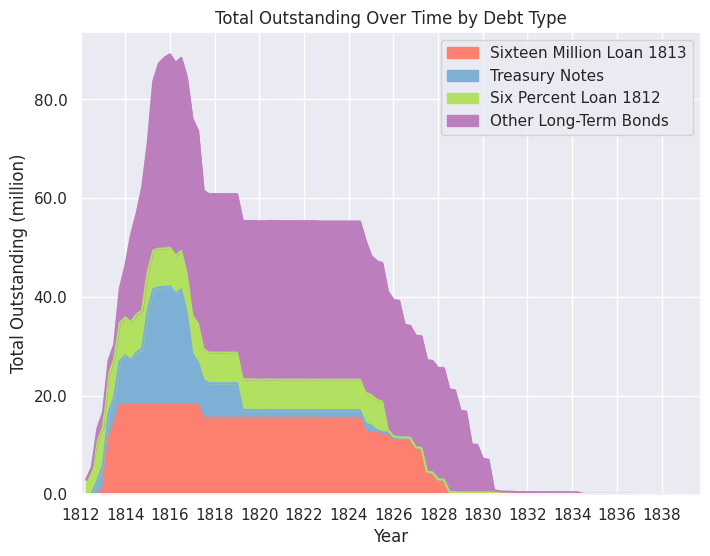

The stacked area plot will help compare total amount outstanding between different bonds. Instead of having every bond and note on one chart, we chose the following bonds and notes below and grouped the rest in an ‘Other’ category. By doing so, the graph remains readable and useful.

Treasury Notes: There were five separate issues of Treasury notes. We decided to group all five issues into one category because the notes in themselves were different from the long-term bonds issued by Congress. Notes were short-term bonds. Therefore, by grouping them together, it becomes easier to compare the quantity of short-term bonds against long-term bonds at any given point.

Sixteen Million Loan of 1813: Based on the research, the Sixteen Million Loan was one of the most important long-term bonds issued by Congress during the war because, according to Perkins, it was the first time the government relied on outside financiers for “investment banking functions”. The primary purchasers were not many individuals, but a syndicate consisting of Astor, Parish, and Girard.

Six Percent Loan of 1812: The first loan authorized by Congress in regards to the War of 1812. Therefore, it would be useful to compare total outstanding of the Six Percent stock compared to notes and loans that were issued later, to see if the amount oustanding for every note/bond increased or decreased as time went on.

# group treasury notes into one dataframe

# Combine all treasury notes into one dataframe

treasury_notes_combined = pd.concat([treasury_notes_1812_quant.copy(), treasury_notes_1813_quant.copy(), treasury_notes_march_1814_quant.copy(), treasure_notes_dec_1814_quant.copy(),

treasury_notes_1815_quant.copy(), small_treasure_notes_1815_quant.copy(), treasure_note_stock_quant.copy()])

treasury_notes_combined.reset_index(drop=True, inplace=True)

# Merge rows with the same timestamps, add Quants

treasury_notes_combined = treasury_notes_combined.groupby("Timestamp", as_index=False).aggregate({"Quant":"sum"})

# Combine all other long-term loans into a separate dataframe

other_loans = [

six_percent_loans_1814_quant,

seven_one_half_quant,

exchanged_six_quant,

temp_loan_1815_quant,

six_percent_loan_1815_quant

]

others_combined = pd.concat(other_loans)

others_combined.reset_index(drop=True, inplace=True)

# Merge rows with the same timestamps, add Quants

others_combined = others_combined.groupby("Timestamp").aggregate({"Quant":"sum"})

import matplotlib.pyplot as plt

import numpy as np

import matplotlib.ticker as mticker

import matplotlib.ticker as ticker

import matplotlib.dates as mdates

# Close all plots

plt.clf()

# reformat dataframe for easier concatenation

copy_sixteen_mil = sixteen_mil_quant

# print(copy_sixteen_mil)

copy_sixteen_mil = copy_sixteen_mil.set_index("Timestamp")

copy_treasure_notes = treasury_notes_combined

copy_treasure_notes = copy_treasure_notes.set_index("Timestamp")

copy_six_percent_1812 = six_percent_1812_quant

#copy_six_percent_1812 = six_percent_loans_1814_quant

copy_six_percent_1812 = copy_six_percent_1812.set_index("Timestamp")

combined = pd.concat([copy_sixteen_mil, copy_treasure_notes, copy_six_percent_1812, others_combined.copy()], axis=1)

combined.columns.values[0] = "Sixteen Million Loan 1813"

combined.columns.values[1] = "Treasury Notes"

combined.columns.values[2] = "Six Percent Loan 1812"

combined.columns.values[3] = "Other Long-Term Bonds"

# combined["sum"] = combined["Sixteen Million Loan 1813"] + combined["Treasury Notes"] + combined["Six Percent Loan 1812"] + combined["Other Long-Term Bonds"]

# print(combined.to_string())

combined = combined.reset_index()

years = combined.index.tolist()

# Set the Seaborn style

sns.set(style="darkgrid")

# Plotting

f_plot = combined.plot(x="Timestamp", kind='area', stacked=True, figsize=(8, 6), legend=False, color=["#fd7f6f", "#7eb0d5", "#b2e061", "#bd7ebe"])

# set x axis tick marks manually

years = pd.date_range(start='1812', end='1839', freq='2Y').year

plt.xticks(pd.to_datetime(years, format='%Y'))

ax = plt.gca()

labels = ['1812', '1814', '1816', '1818', '1820', '1822', '1824', '1826', '1828', '1830', '1832', '1834', '1836', '1838']

ax.set_xticklabels(labels)

# set monthly locator

f_plot.yaxis.set_major_formatter(FuncFormatter(lambda x, _: '{:.1f}'.format(x / 1e6))) # Removes '1e6' from axis

# print(combined["Other Long-Term Bonds"].max())

# f_plot.yaxis.set_ticks(np.arange(0, 7, 5e5))

# Adding labels and title

plt.xlabel('Year')

plt.ylabel('Total Outstanding (million)')

plt.title('Total Outstanding Over Time by Debt Type')

plt.legend(loc='upper right')

# Display the plot

plt.show()

/tmp/ipykernel_2027/1423170173.py:40: FutureWarning: 'Y' is deprecated and will be removed in a future version, please use 'YE' instead.

years = pd.date_range(start='1812', end='1839', freq='2Y').year

<Figure size 640x480 with 0 Axes>

Major Sources#

Bayley, R. A. (1881). The National Loans of the United States From July 4, 1776 to June 30, 1880. Washington: Government Printing Office.

Kagin, D. H. (1984). Monetary Aspects of the Treasury Notes of the War of 1812. Cambridge University Press.

Morales, L. R. (2009). The Financial History of the War of 1812. University of North Texas.

Perkins, E. J. (1994). American Public Finance and Financial Services 1700-1815. Ohio State University Press.